Ever Wonder How Coffee Futures Shape the Price in Your Cup?

Imagine you’re savoring a bold cup of Indonesian coffee on a rainy morning. As the aroma drifts through the air, have you ever stopped to think about what determines the price of your favorite brew? Behind every sip of robusta coffee lies a world of high-stakes trading, risk, and strategy—where fortunes can be made or lost on the flicker of a chart. Welcome to the fascinating world of robusta coffee futures, where bar charts aren’t just numbers—they’re the heartbeat of the global coffee trade.

What Are Robusta Coffee Futures, and Why Should You Care?

Let’s break it down. Robusta coffee futures are contracts traded on global exchanges—think of them as agreements to buy or sell robusta coffee at a future date, for a price decided today. For coffee farmers, roasters, and even your local café, these contracts are a lifeline. They help businesses hedge against wild price swings caused by weather, politics, or a sudden spike in demand.

Unlike arabica, robusta coffee (Coffea canephora) packs a punch—more caffeine, stronger taste, and a resilience that keeps it growing in diverse climates. Learn more about the differences between robusta and arabica.

But what truly drives prices in the robusta market? Let’s dive into the inner workings:

- Global supply & demand: A drought in Vietnam or bumper crop in Brazil can send prices soaring or crashing.

- Hedging strategies: Producers lock in future prices to protect their livelihoods, while big brands ensure cost stability.

- Speculation: Investors and traders try to predict where prices will go next, adding liquidity and complexity to the market.

- Quality standards: Futures contracts include specs on bean size, moisture, and defects, ensuring fair trade across borders.

- Diversification: For some, trading robusta futures offers a unique way to spread risk across different investments.

Want a deeper look at the Indonesian coffee scene? Explore the state of the Indonesian coffee industry.

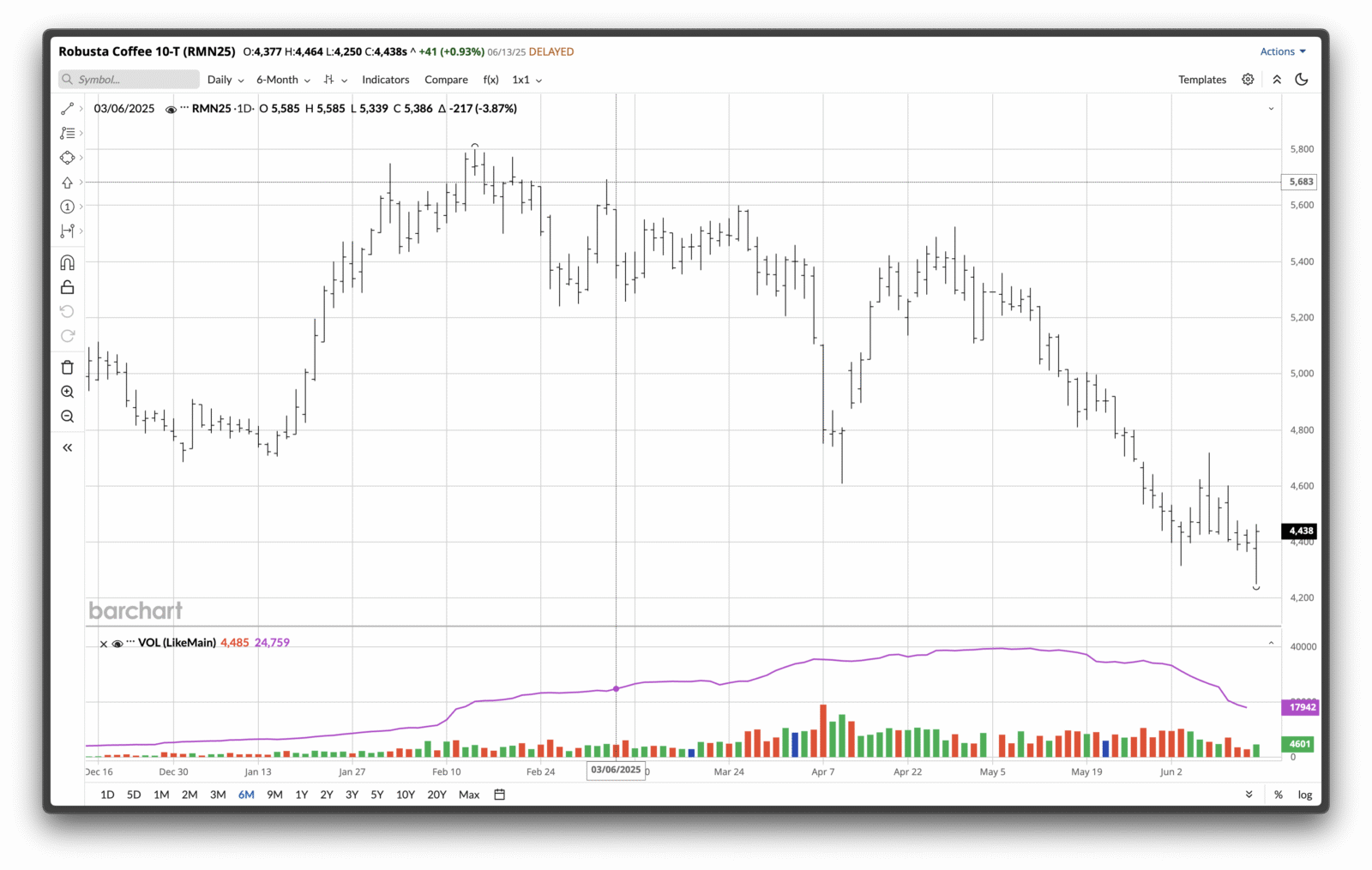

Reading the Market’s Pulse: Bar Charts Explained

Ever stared at a wall of wiggling lines and wondered what it all means? Enter the bar chart—the essential tool every coffee trader relies on.

Bar charts visually map out price movements over time. Each bar tells a story:

- Top of the bar: The highest price reached.

- Bottom of the bar: The lowest dip.

- Left tick: Where prices started (opening).

- Right tick: Where they ended (closing).

What makes bar charts powerful? It’s how quickly you can spot trends, swings, and patterns—all at a glance.

How to Read Bar Charts Like a Pro

Let’s make this real. Imagine you’re analyzing robusta coffee futures and see a series of long bars. What does that tell you? High volatility—prices are jumping. Shorter bars mean calmer days.

Here’s what to look for:

- Trends: Are the bars marching upward (bullish) or tumbling down (bearish)?

- Volatility: Are price swings big or small? Longer bars mean more action.

- Patterns: Watch for classic shapes—“head and shoulders,” double tops, and more. These can hint at reversals or new surges.

- Support & Resistance: Draw horizontal lines across price floors or ceilings to spot where prices might bounce or break through.

If you want to see how other specialty coffees fare in the global market, check out Indonesia’s position among top coffee-producing countries.

Why Bar Charts Matter for Robusta Coffee Futures

Traders don’t just look at numbers—they feel the story behind each move. Bar charts help farmers decide when to sell, roasters when to lock in prices, and investors when to make their move. Even if you’re just a coffee lover, understanding these charts gives you a deeper connection to every cup you brew.

Want to know how Indonesian coffee stands out in quality? Discover the world of specialty coffee grading and why robusta deserves your attention.

Your Next Step: Bring the Market to Your Mug

Coffee isn’t just a drink—it’s a global adventure shaped by weather, markets, and people with nerves of steel. So next time you sip robusta, remember the invisible web of charts and contracts behind that rich, satisfying flavor.

Curious about how to taste the finest robusta yourself? Start your journey with a sampler pack of Indonesian coffee or discover the secrets of brewing at home like a pro.

So, what story will your next cup of coffee tell?